We are sure there are many parts of the tax code that you don’t like, particularly the parts where you have to keep tax records. Here’s a court case that will help you appreciate the need for good tax records.

We know that you don’t like it. But you have to accept it.

You are in a business and personal partnership with the government. One portion of your partnership agreement is the tax code.

Proving Basis in the Home

Riley and Joyce Pendergraft bought their home in San Jose, California, for $45,000. By the time they sold the house 28 years later, its value had grown to $790,000.

The Pendergrafts could pat themselves on the back for some of that growth in value. They installed a swimming pool, built a second story, and remodeled the interior and exterior of the home. Overall, they estimated that the projects cost them $286,070.

Note the bad word “estimated” in the last sentence above. The Pendergrafts did not keep good records—an expensive mistake.

The Pendergrafts sold the home and claimed no taxable gain because of the $286,070 in improvements to the home.

During its audit, the IRS found only $56,284 in improvements to the home since its purchase. The court upped that amount to $82,039, creating $101,907 in taxable capital gains.

Since improvements add to basis and reduce taxable capital gains, keeping track of improvements is important. That’s where the Pendergrafts failed: bad paperwork. But what the heck—the Pendergrafts saved a few hours of paperwork, and it only cost them the taxes they had to pay on $101,907 of capital gains!

Whoa, what?

Records Cost

The Pendergrafts owned their home for about 28 years, and they made various improvements during those years, including a second-story addition and a swimming pool. How in the world would they keep records for 28 years?

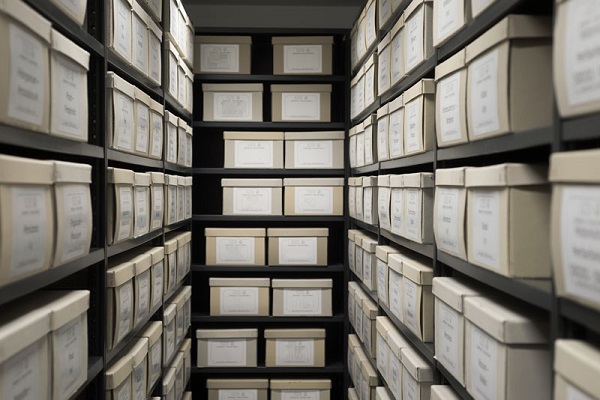

You can find many methods. One simple method is to keep a large envelope where you put the home improvement receipts and canceled checks. (Note: you need both receipts and canceled checks or other proof of payment.)

How much time would it take to put the receipts and canceled checks into the envelope? Not long. According to our estimates, certainly not more than 15 hours for the Pendergrafts.

Now, let’s examine how much the failed record keeping cost the Pendergrafts. Let’s start with their lost time.

They searched the house for what records they could find (say, two hours).

- We don’t know, but we think they had to go to the city or county and dig out the $56,284 in costs from the building permits, which they used during the audit and which the IRS allowed as additions to basis (say, two hours with the IRS and three hours with the city and/or county digging out the permits).

- They had to identify and then meet with the lawyer who represented them in Tax Court (say, two hours on this matter).

- They had to pay the lawyer (say this took about one hour).

- They testified at trial (say, four hours with waiting times, driving, and finding parking).

- They had to pay the taxes and deal with that paperwork (say, an hour).

Given the above total of 15 hours, we could be at breakeven on the hours needed that would have avoided this trouble. But the 15 hours listed above caused real anxiety, so you have to give them more weight.

And now we have the money part. The Pendergrafts paid the lawyer who helped them. Let’s say it was a bargain price of $5,000 after taxes for this part of their tax case.

The Pendergrafts have the federal and state income taxes on the $101,907 at a combined federal and state tax rate of, say, 25 percent, for a total of $25,477. They also have federal negligence penalties of about $3,052. There’s more, of course, such as California penalties, plus interest for the time during which the taxes were underpaid.

Let’s make an estimate of, say, $35,000 in total for the failure to keep records proving the cost of improvements.

To put this in a positive frame, the Pendergrafts would have paid themselves $2,222 an hour in tax-free dollars had they kept the tax records they needed ($35,000 ÷ 15).

Get Money Back for Your Improvements

How much you spent for improvements should not be a mystery. Keep your home-improvement expenditures in a permanent file.

You never know when you will need to prove the basis in your home. Further, you can’t count on the tax-free $250,000 and $500,000 being there when you sell. Tax law changes. Benefits come and go.

Home prices can escalate. You simply need to be prepared with receipts and invoices for those improvements. You also need canceled checks, which prove that you paid the bills.

Improvements add to your basis and reduce your taxable gain. This is a fundamental rule of tax law, which means you can count on this rule as long as there’s a tax code.